End of the Empire is a twice-monthly feature on all news relating to the transition from the unipolar world of the US Empire to a multipolar world.

In March, news media was abuzz with the announcement from Beijing that Iran and Saudi Arabia had mediated a return to cordial relations and a commensurate re-opening of embassies. At the time, analysts saw it as an example of how the US is losing its grip on the Middle East, but particularly Saudi Arabia.

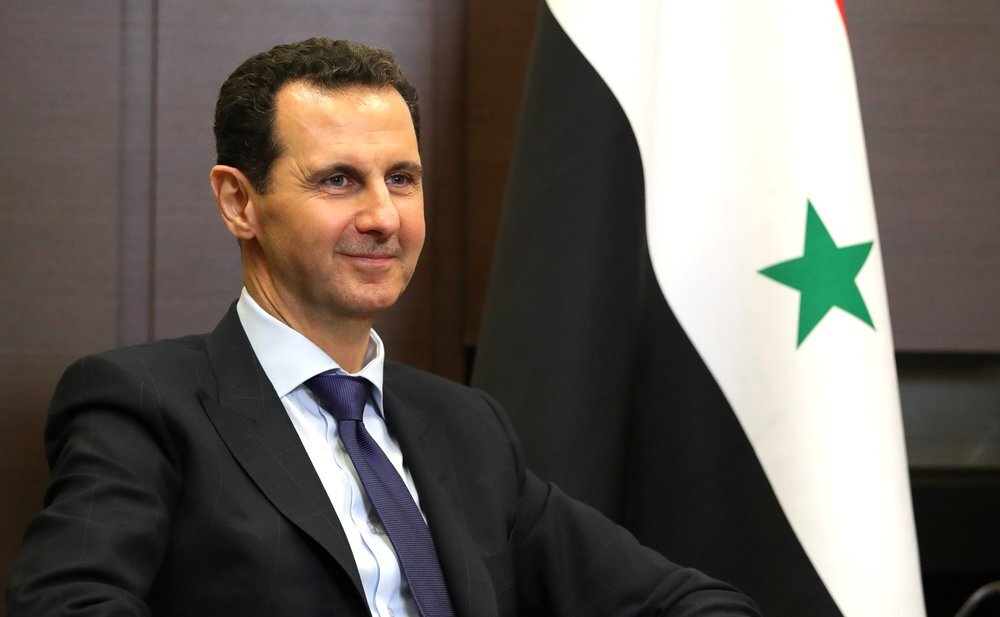

In another blow to the Americans’ foundering role as regional hegemon, the Arab League voted to readmit Syria into their numbers after 13 of the 22 nations held a vote in Cairo on Sunday.

“Syria, starting from this evening, is a full member of the Arab League, and from tomorrow morning they have the right to occupy any seat,” said Ahmed Aboul Gheit, the Arab League’s secretary-general, adding that it didn’t mean the region had completely normalized relations with Syria; “these are sovereign decisions for each state individually,” he noted.

The US continues to maintain crippling sanctions meant to deliberately “prevent reconstruction” of the nation that was subject to a war against a mixture of jihadists and rebels armed and supported by the US, the UK, and Saudi Arabia.

The Arab League ministers have voiced the necessity for Syria to reclaim all of its territory, including a large part of the east held illegally by US troops for the purpose of stealing Syrian oil wealth to prevent the Assad regime from having anything to stimulate economic activity.

In a call with the foreign minister of Jordan, the US Secretary of State Antony Blinken diverged from the long-held policy of the US for opposing Syrian normalization under any circumstances. His divergence was to stipulate that normalization should not be done unless “there is authentic, UN-facilitated political progress in line with UN Security Council Resolution 2254,” Blinken said, according to the State Department.

UNSCR 2254 calls for “an inclusive and Syrian-led political process,” of reconciliation.