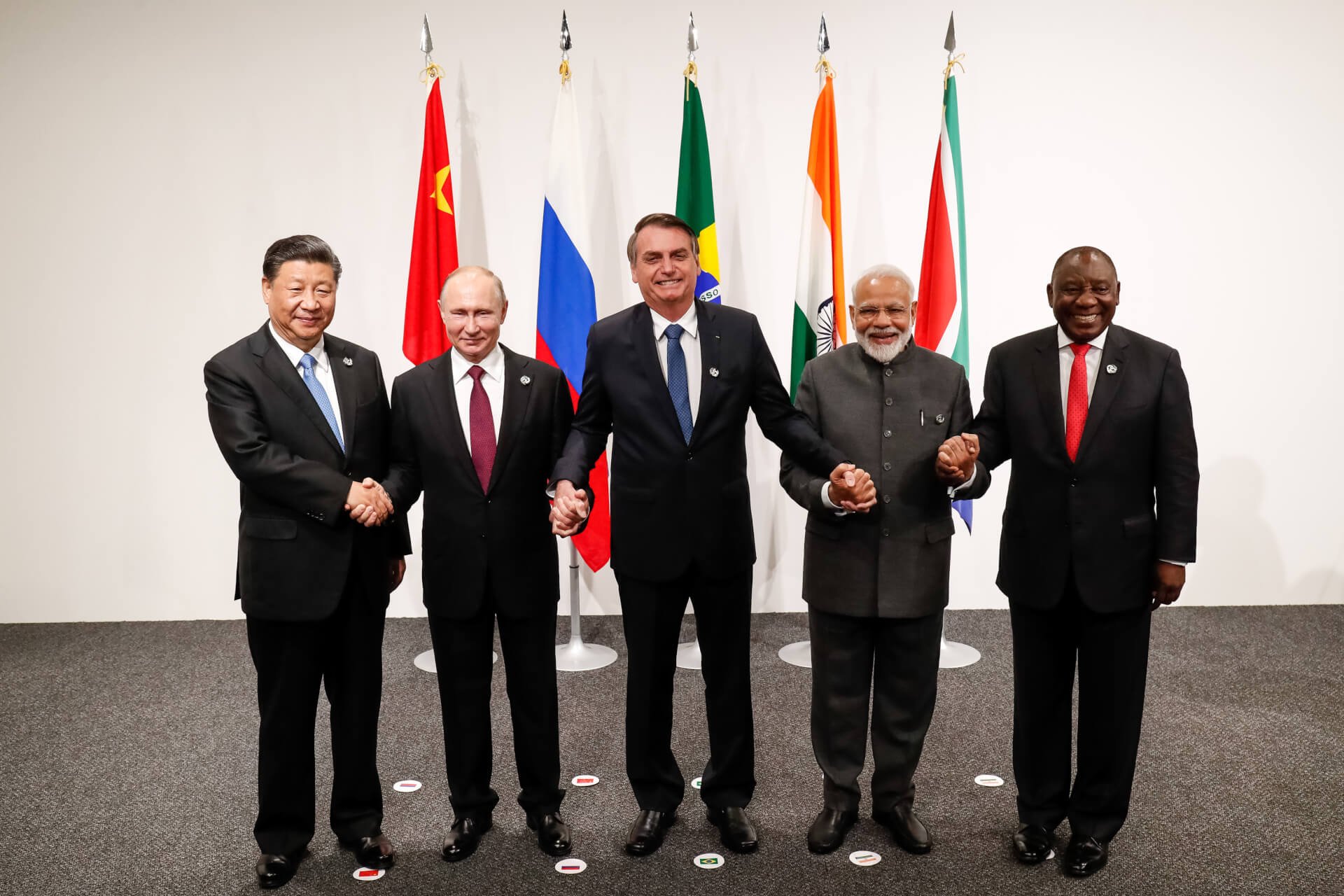

In June during the 14th annual BRICS summit, it was announced that the five economies would be seeking to create a new world reserve currency to replace the U.S. dollar.

This is equivalent in economic terms to the BRICS countries saying that they would militarily depose the United States of all 800 oversea military installations; in a word, it’s a world-changing development.

Yet economists have been shaking off ideas that other large economies could usurp the need to transact in U.S. dollars for years, and as the Dollar Index rapidly gained strength over this summer’s interest rate hikes, they seemed to be correct once again.

Last year, the Russian Federation signed a security cooperation agreement with Saudi Arabia. It was originally a security cooperation agreement with Saudi Arabia that gave the United States dollar its reserve currency status — nations needed to transact in dollars to buy Saudi oil.

In March of this year, China and Saudi Arabia revived years-old discussions about settling some oil accounts in Chinese RMB, leading to talk of a “petro-yuan” that would potentially drag $600 billion to $1 trillion worth of transactions out of the dollar a month.

All things considered, there’s never been a greater flurry of activity to suggest that the United States is about to lose much of the dominance she enjoys over the world economy. Saudi Arabia has potential new protectors and arms dealers, a new currency may be used for buying and selling oil, and the governments of 41% of the world population, 24% of the world GDP, and 16% share in world trade, are looking to create a new inter-state currency.

The missing golden piece

There are three things that can give a currency value: if it’s redeemable for a commodity, if it’s created by a country with strong domestic productive capacities or a strong export market, or if it’s widely or extremely convenient to use.

During the Basel III Agreements made by the Bank of International Settlements, allocated gold, which could simply, though not entirely accurately be called physical gold, was made a Tier 1 reserve asset—the highest indicator of a bank’s financial strength. The only other Tier 1 reserve asset has for years been the United States Treasury Bill.

The agreement was made in 2010 and scheduled for 2013, but implementation has repeatedly been delayed. It’s now believed to become the regulatory framework for banking institutions in January of 2023. Over the last ten years, every BRICS nation has been increasing or dramatically increasing its gold reserves, the most dramatic of which was Russia, which from 2010 to 2022 has quintupled the national gold reserves.

source: tradingeconomics.com

Russia’s reserves now stand at 2,300 tonnes. China merely doubled her reserves, which stand just under 2,000 tonnes.

source: tradingeconomics.com

South Africa and Brazil added small amounts to their national reserves over the last decade. Saudi Arabia doubled the kingdom’s gold reserves over 10 years.

India’s gold reserves also doubled from 400 tonnes in 2010 to 800 tonnes in 2022, but it’s the velocity of gold purchases that makes India stand out as the world’s second-largest annual purchaser of gold.

source: tradingeconomics.com

By contrast, European Union states have repeatedly sold, or allowed the stagnation of, their gold reserves. Italy for example hasn’t increased her gold supply above 2,400 tonnes in 25 years, while over the same period, Germany has sold 100 tonnes of her gold reserves, depleting them from 3,460 tonnes to 3,360 tonnes.

source: tradingeconomics.com

That may seem like plenty of gold to ensure against financial disasters, however with a shrinking Euro even in the face of European Central Bank interest rates rising above zero for the first time in years, more still may be needed.

The 21st-century world economy has been one of fiat currencies—paper money backed by nothing other than a country’s exports, and their laws. If the BRICS countries are amassing gold as a way to return part of the world to a gold-backed currency as was the case in the post-World War II status quo until 1971, it would force the West into taking a position of fiscal and financial austerity that it hasn’t been forced to endure for a long time.

There hasn’t been a gold standard anywhere on Earth for 50 years, and it’s a stretch to imagine there will be one. Yet it’s believed that “paper gold” i.e. the ownership of a gold derivative in non-physical form and a Tier III (higher risk) asset under the Basel III Agreement, outnumbers physical, allocated gold on balance sheets by 400%.

By buying as much physical gold as possible, the BRICS nations may be actively removing paper gold from being turned into physical gold by Western banks.

It’s impossible to say whether the 2020s will be marked by a new world reserve currency backed by oil and gold simultaneously, but it’s certain that such a reality has A: never been as possible as now, and B: never looked more likely. WaL

PICTURED ABOVE: Chinese President Xi Jinping, President Vladimir Putin, Brazilian President Jair Bolsonaro, Prime Minister Narendra Modi, and South African President Cyril Ramaphosa.

If you think the stories you’ve just read were worth a few dollars, consider donating here to our modest $500-a-year administration costs.

Thank you for the very informative article.

Please add the year (Aug 19, 2022) to your articles.

The year is helpful when doing financial research.

Best regards for a prosperous 2023.

Will it be pegged to a specific amount of gold? Or can it erode over time?

Will deflation be built in to this new currency?

If so, the less you spend the richer you get.

I predict excellent economic performance by the currency and utter ruin for teh BRIC nations.

There is a reason not a single country backs their currency with gold on a static level and if the BRICs routinely shrink the exchange rate, trust in it as a currency will be no better than the aggregate trust of the nations involved.

Word to Brazil and South Africa…. Run. You are the hosts the leeches are trying to get a hold on. Prepare to surrender to the CCP if you are foolish enough to buy in to this scam. Witness the Belt and Road "partnerships" worldwide. How many are happy with how it turned out? Now they want to "share" control of your money supply? You’re okay with that?