In this political climate, no one should take what the employees of a single Russian embassy say as gospel, but nevertheless, for those aware of their accelerated desire to distance themselves from the US dollar, they would consider it more likely to be true that the Russian Embassy in Kenya was in fact confirming that the economic alliance known as BRICS has agreed to create a new international reserve currency to be backed by gold.

A BRICS currency backed by gold is something that macro-financial analysts have been speculating could be possible for some time, but the theory gained a lot of steam after the 14th annual BRICS summit in June 2022, when the bloc announced they were considering it.

At the time WaL reported that it had never been more possible, and never looked more likely, for some entity to attempt to challenge the domination of the US dollar in international settlements.

There is some alignment in that the announcement was made from an embassy in Kenya, and that the next annual BRICS Summit will be held in South Africa next month. Could a formal announcement be made then?

As WaL reported in its last story on a BRICS currency, BRICS nations continue to stockpile gold. Russia has continued to increase her gold reserves which had already been steadily growing for decades. She stockpiled another 35 tonnes since last year and staked out a new high for the 21st century. Between July 2022 and now, China has purchased another 100 tonnes, also making a new high for the century. This is the same case for India.

That would be a key indicator that such a plan is already in motion—to try and outcompete a fiat currency with one backed by gold, it would help to own as much gold as you can. The next requisite would be a gradual removal of dollar-denominated reserves from world banks—a very present, albeit slow, trend.

The IMF lists the decline of US dollar-denominated assets as foreign currency reserves in the global banking system as $300 billion since the start of Q1 2022. However, this should be correctly viewed in a trend of dumping almost all foreign currencies—probably because of the global trend of rising interest rates making debt instruments which pay these currencies less valuable.

It’s estimated that paper claims to physical gold outnumber the weight of physical gold available for holding by 4 to 1, so any ounce of gold bought today potentially removes the chance of real ownership over the metal from three other people.

Slow and steady

For China, which has the most to lose in any potential trade complications with the United States, the CCP will hope any move to de-dollarize the global economy will come slowly. The Chinese government, whether imperial, republican, or communist, has always been content with low time preference. They signed away the island of Hong Kong to the British in the Treaty of Nanking for 99 years, with every intention of holding them to that deal, despite British negotiators fully believing that 99 was as good as infinity.

There was a sort of panicked stupefaction when, in the 1970s, the world’s oldest continually-existing civilization began planning to take their island back as per the agreement, and no one had any idea what was going to happen.

China is the US’ largest trading partner, and though President Biden and his predecessor Trump waged miniature trade wars against East Asia’s largest economy, neither of them thought of anything like a decoupling. But if the White House is to see China announcing alongside Russia that they will be trying to take a larger share of global trade by introducing a direct replacement for the dollar, it could be taken as an “escalation of hostilities” writes Stefan Gleason at Money Metals brokers.

“The mere fact that gold is being considered by BRICS countries as a basis for international trade should incentivize central banks – and individual investors – to accumulate precious metals,” says Gleason. “If gold’s role as a global alternative currency is to increase, then so, likely, will its price.”

There hasn’t been a gold standard on the Earth for over 50 years, and there’s still a chance there won’t be one, if for no other reason than that it’s difficult to make people believe longstanding tradition will change.

Even so, writes Gleason, ever since the unprecedented attempt to strangle the Russian economy through expunging her from the SWIFT system for international payments, or the repeated actions of Western governments to freeze access to gold reserves of governments they don’t agree with, such as Venezuela, countries around the world affiliated with BRICS or not have been repatriating gold reserves form Western banks.

It will be fascinating to see what happens if BRICS should debut a currency this August, and all the more fascinating to see how global currency markets shift in the year to follow. WaL

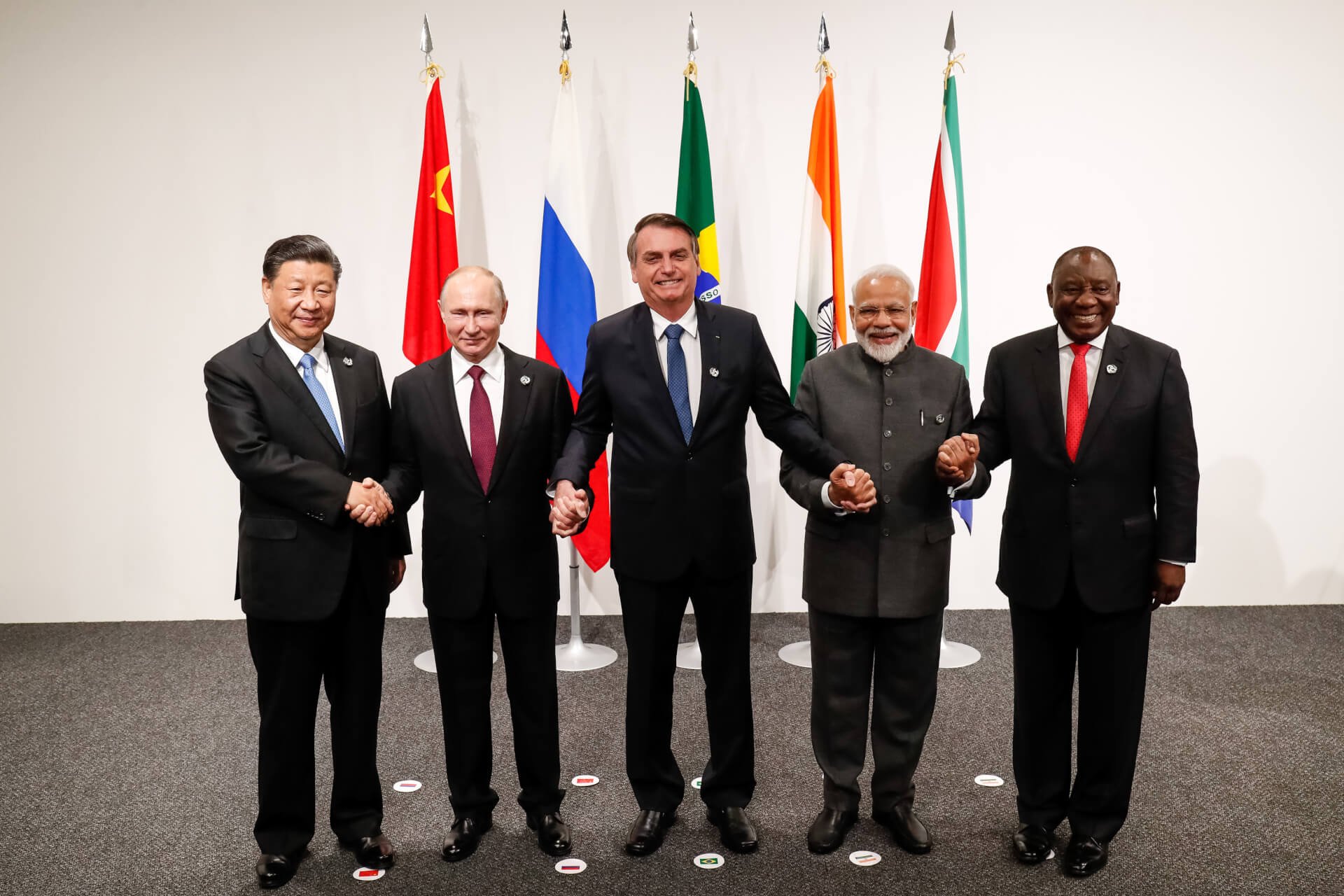

PICTURED ABOVE: Heads of state of the BRICS nations at the 14th Annual BRICS Summit.