Spot prices relevant to this news: Pound/USD £1.11 – 30-year Gilt £4.729

LONDON, October 10th, 2022. On September 30th, WaL reported that Britain threw in the towel in the fight against inflation after they reverted to a policy of quantitative easing (QE).

Now the Bank of England has announced they are doubling the size of their bond buy-back scheme to further hang on to the recent rebound in the value of the pound, and keep markets steady.

In a statement, the BoE said they would increase the maximum amount in buyback auctions of long-term government bonds, known in Britain as “gilts,” to £10 billion per-day. This is a doubling in the original plan for £5.5 billion a day in bond buybacks.

“In the final week of operations, the Bank is announcing additional measures to support an orderly end of its purchase scheme,” it said in a statement.

Going further down the recession-fighting rabbit hole, the BoE said they planned to set up a temporary “expanded collateral repo facility” which will help banks meet liquidity requirements for the maintenance of clients’ accounts, such as pensions, caught up in the market turmoil.

Al Jazeera described it as a liquidity insurance operation, and that it would accept a wider range of collateral as insurance. In other words this means riskier assets, such as corporate bonds, that would normally not be used to back something as supposedly and necessarily concrete as a pension, could come into play to backstop banks requirements for cash holdings.

The BoE said that this insurance is only going to continue through to the end of the week. Whether they acknowledged it or not, it’s a totally irresponsible plan were it to go on long term.

PICTURED: Now-Finance Minister Kwasi Kwarteng meets with Majid bin Abdullah Al-Qassabi, Saudi Arabia’s Minister of Commerce In 2021 under the Johnson Government. PC: CC 2.0.

“Too little, too late”

US financial ratings agency Fitch downgraded the credit rating in Britain from “stable” to “negative” recently, prompting criticism of the BoE’s moves as “too little, too late” according to The Independent.

UK Finance Minister Kwasi Kwarteng announced a controversial short term budget that included £45 billion in tax cuts without a single concurrent reduction in government spending, in other words, huge government borrowing.

The UK’s Office for Budget Responsibility will not release updated guidelines until November, which is also the next time the BoE is scheduled to meet to address interest rate changes which currently sit at just 2.25%, which amount to negative 7.50% the rate of price inflation.

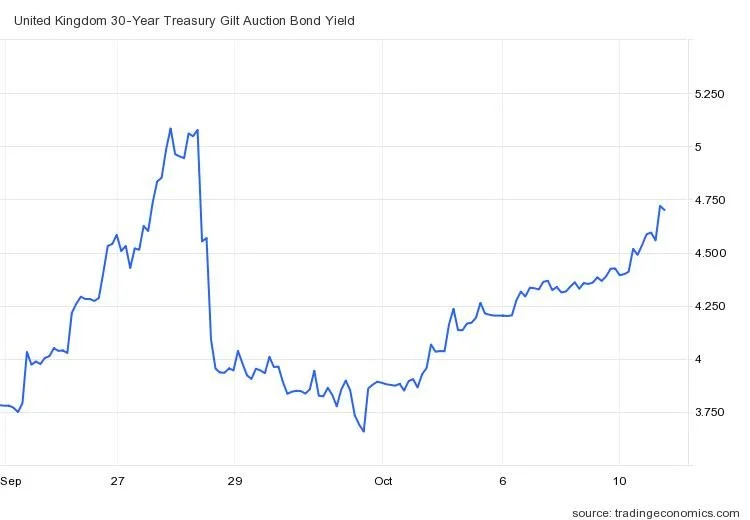

Just four days remain in the government’s bond buying program. Following the announcement, yields on gilts fell from record-setting 5% down to a more stable, yet still high 4%, although they have steadily climbed up to 4.7% over the last two weeks.

Higher yields on longer term gilts reflect sentiment that, since the bonds pay sterling issued by the government, that sterling is rising in volatility. The strongest economies on Earth have very low yields on their longer-term bonds, reflecting not only the stability of their security markets, but also the purchasing power of their fiat. A German 30-year is at about 2.30%, while an Indonesian 30-year is 7.3%.

A return to 5% yields could prompt a further extension in the bond-buying program, causing further inflation of the British money supply and a potential greater fall in the value of sterling.