PICTURED: Sen. Braun (R – IL) arguing for his budget on the Senate floor.

The Senate has begun work on formulating a budget for the federal government between the fiscal years 2023 and 2032.

Under the bill’s current projections, the government would grow the amount of money spent beyond what it collects in taxes for the next 5 years, growing by 40% in the process, while shrinking back to levels seen today by 2032.

Notably, the projected budget outlays would not shrink back 40% as with deficit spending, suggesting the latter will be made up with in tax revenues or Federal Reserve financing.

The process would accumulate an additional $8.5 trillion in national debt, all of which is to be held by the public, which presumably means at the moment there is no nation willing to lend.

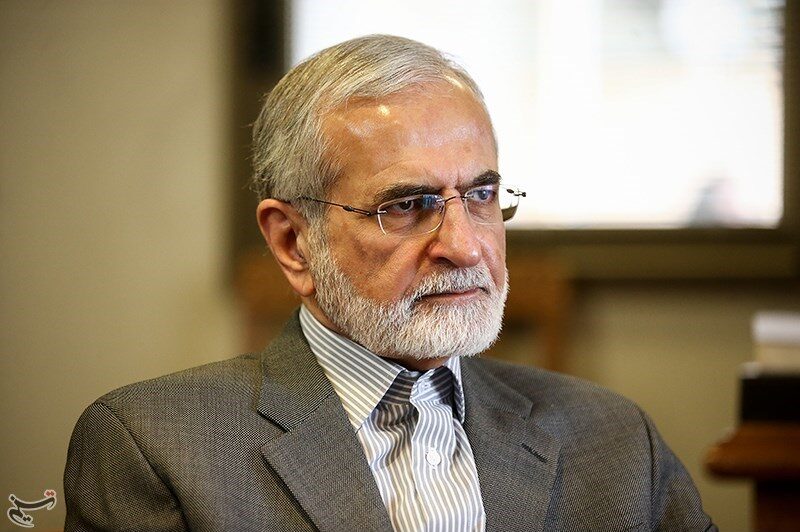

A vote on the bill was forced by its author Senator Mike Braun from Illinois, who ironically touts himself as a businessman “fed up with Washington’s wasteful spending,” and who actually described it as a “balanced budget”. The vote failed 34-65.

Braun has collected the support of a variety of America First organizations, taxpayer associations, and even some liberty-minded Republican groups, all of which seem to be under the idea that this is a path to fiscal responsibility.

The bill states clear as day that neither government spending nor national debt will be lowered at any point during the next 10 years, and that at best, deficit spending will, after 10-years time, be lowered by around $50 billion, equivalent to around 15% of the projected deficit in a hypothetical 2032, or equivalent to a twentieth, of a fortieth, of what the national debt would be under the proposed budget.

PICTURED: The relation of government outlays to deficit spending.

Among the major considerations, the defense budget would not reduce back after 2027 as with the deficit spending, but would continue to rise until FY 2032 when it would be $997 billion, which when adding in the intelligence divisions, Veterans Affairs, and the Dept. of Energy spending on the nuclear stockpile, would be closer to roughly $1.12 trillion.

Another major consideration is what will the government, in a decade, be spending as interest on this mammoth debt. By 2027, when deficit financing is expected to peak at $1.2 trillion above tax revenues, the interest on the debt will be $750 billion. By 2032, when deficit spending is projected to have returned to current levels, which the proposed budget claims to be around $710 billion, the interest on the national debt will have grown to $1.07 trillion, or around 44% of income tax revenues.

This is just the first iteration of what will likely become a much-changed bill when it finally makes it to the President’s desk. For example, 19 special stipulations are listed at the end of the bill that allow Senators to revise or make changes to any of the amounts provided it’s to fulfil various purposes, which have a very broad categorization, such as the blocking of implementing of fracking bans, providing tax relief to the middle class, improving relations with Canada, reducing prescription drug costs, and supporting “robust intellectual property protections”.

These are permitted “provided that such legislation would not increase the deficit over either the period of the total of fiscal years 2023 through 2026 or the period of the total of fiscal years 2023 through 2032,” in other words provided that they are somehow funded in a way not related to deficit spending.